BANKING & FINANCE

The AI & Analytics Engine for

The AI & Analytics Engine for

Banking & Finance

The AI & Analytics Engine provides a solution for banks and financial institutions looking to gain a competitive advantage by capitalizing on innovative technology.

The Engine is an AutoML tool that presents an opportunity to directly impact profitability with use cases uniquely designed for a machine learning platform.

Using Data for a Competitive Edge

The fiercely competitive banking landscape are forcing banks and financial institutions to adapt to remain competitive.

Utilizing machine learning has proven itself to be one of the primary ways banks and financial institutions can gain an advantage, but the cost and time needed to bring models to production has meant that it is often not utilized by banks.

The AI & Analytics Engine allows technical and non-technical users to automatically build complete prediction machine learning pipelines and generate value from data.

The Engine speeds up time-to-value for machine learning projects like customer churn prediction, customer lifetime value prediction, and customer segmentation.

Machine Learning Powered

Predictions that Drives Results

19%

reduction in customer churn rates

$260,000

average saved in retained

revenue

15x

average return on

investment

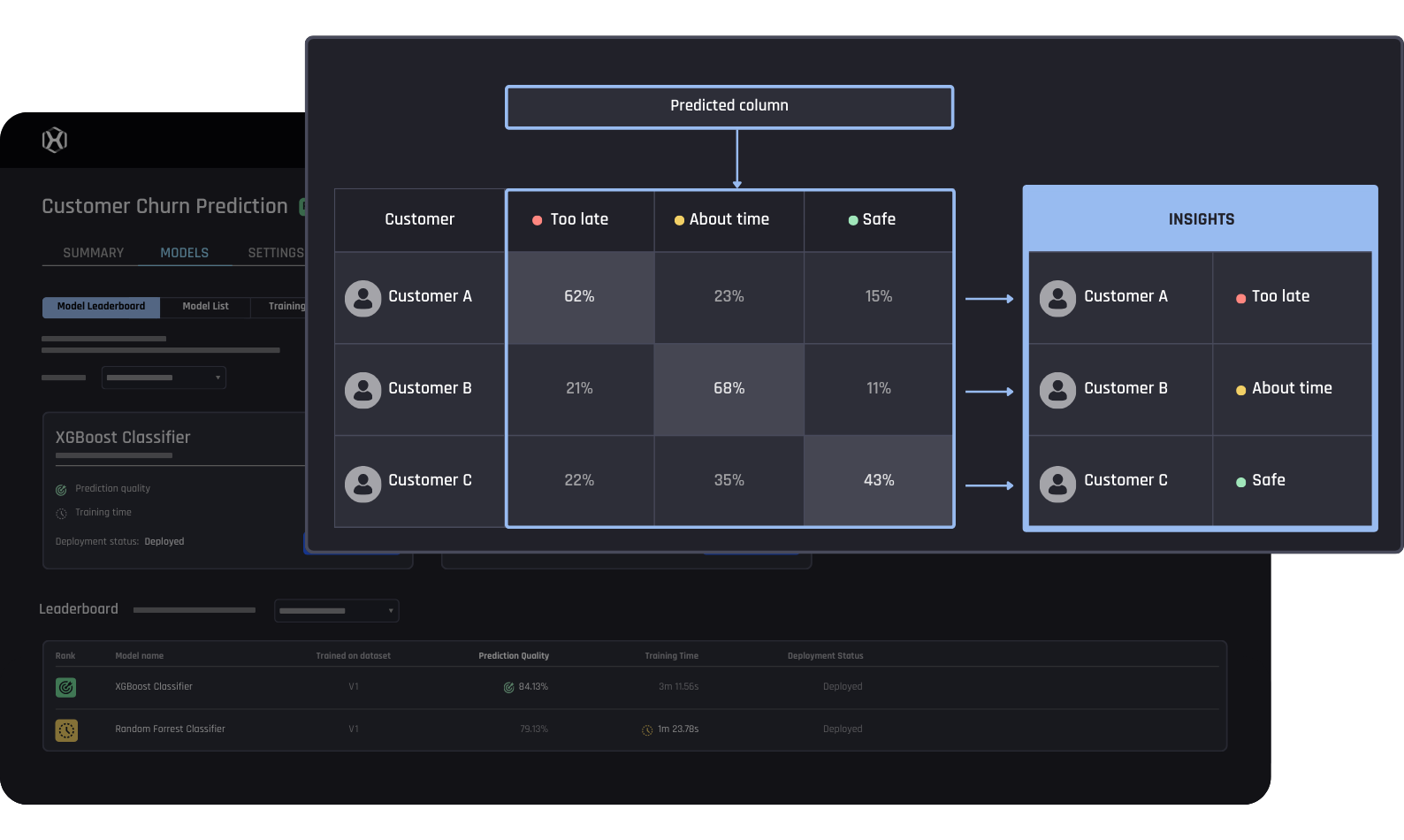

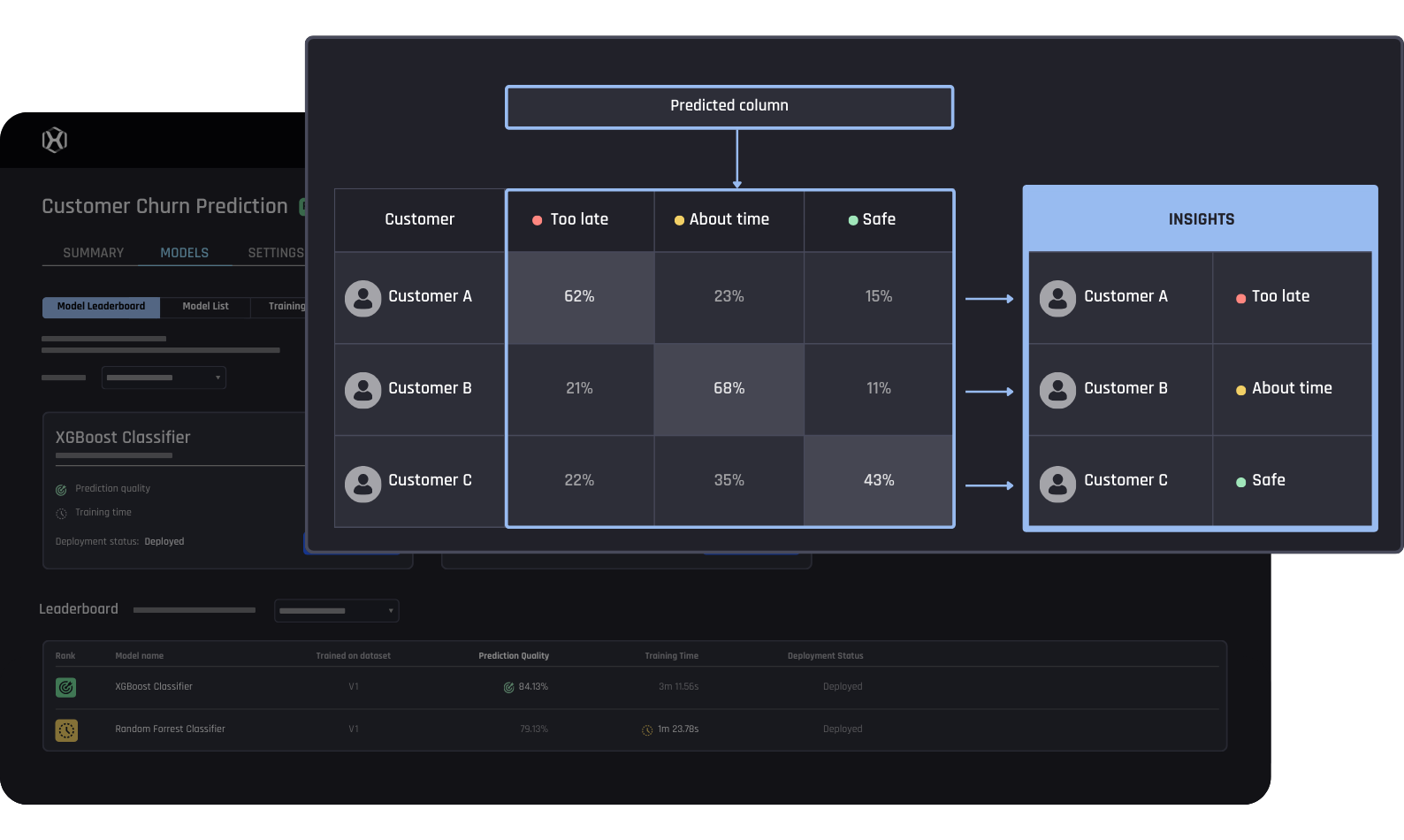

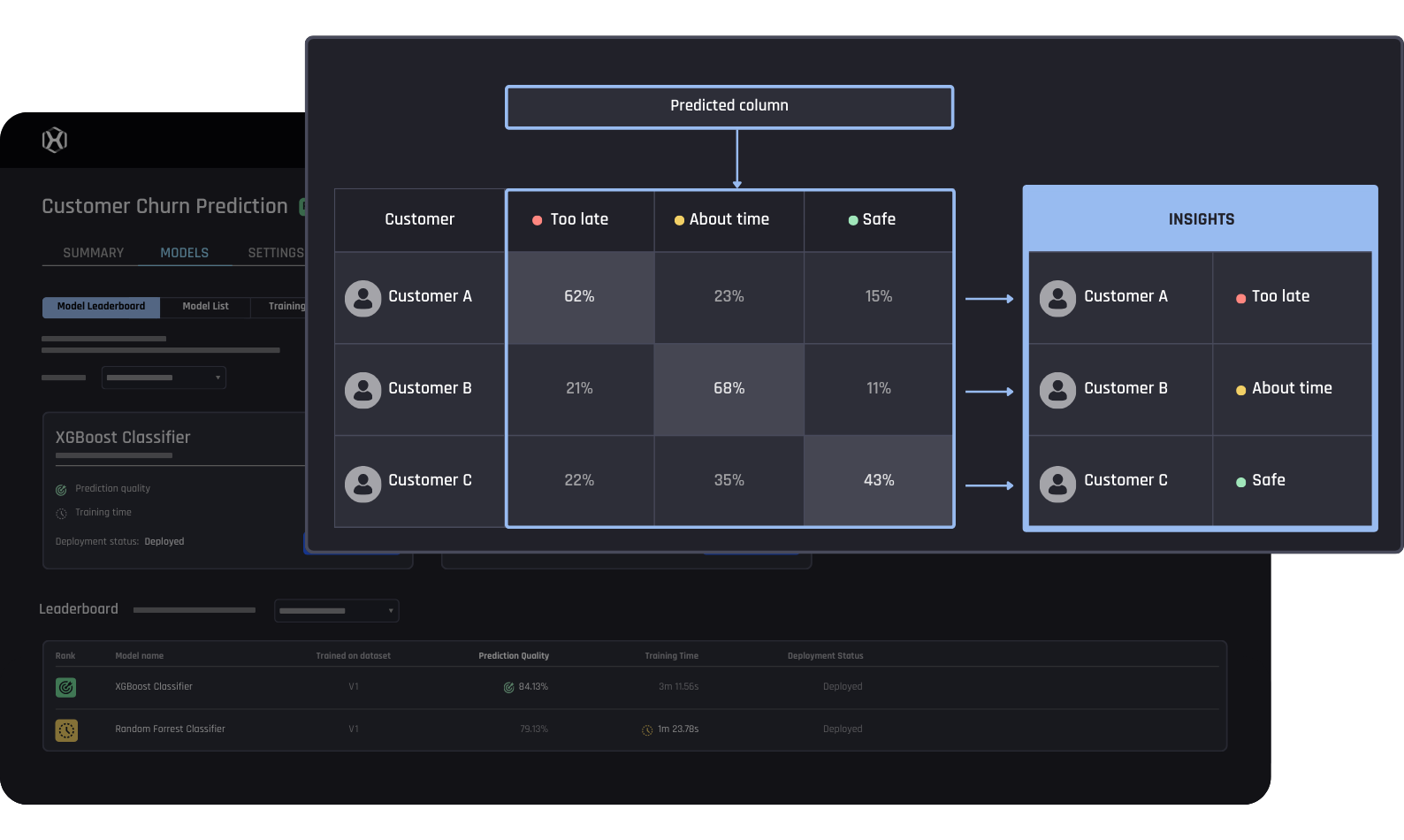

Customer Churn Prediction

The AI & Analytics Engine’s customer churn prediction solution allows banks to identify customers likely to switch to a competitor in the future, giving them an opportunity to proactively address it ahead of time. Keep customers from churning and retain revenue that would otherwise be lost.

Generate churn probabilities for each customer

Increase customer loyalty and revenue

Decrease customer churn rates

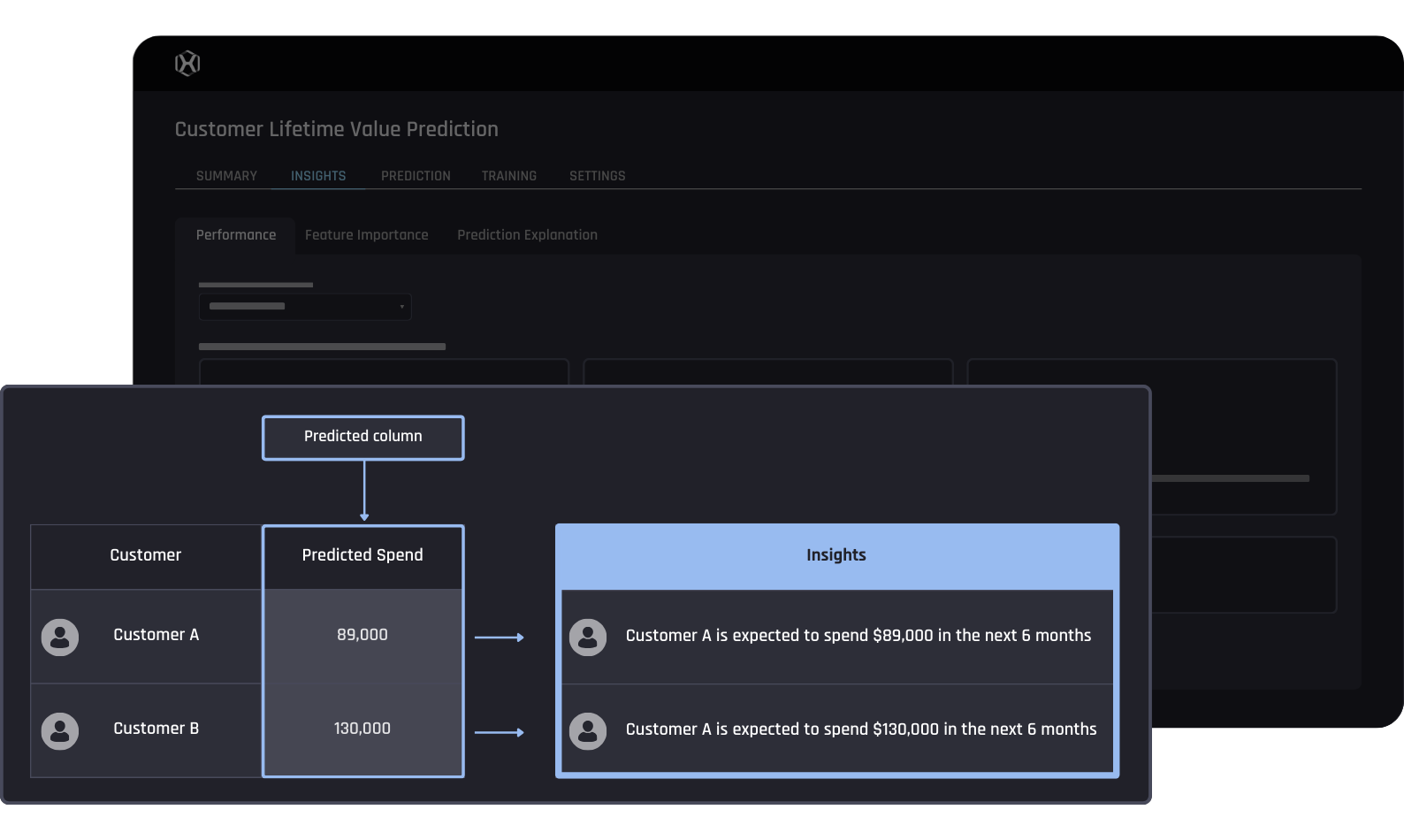

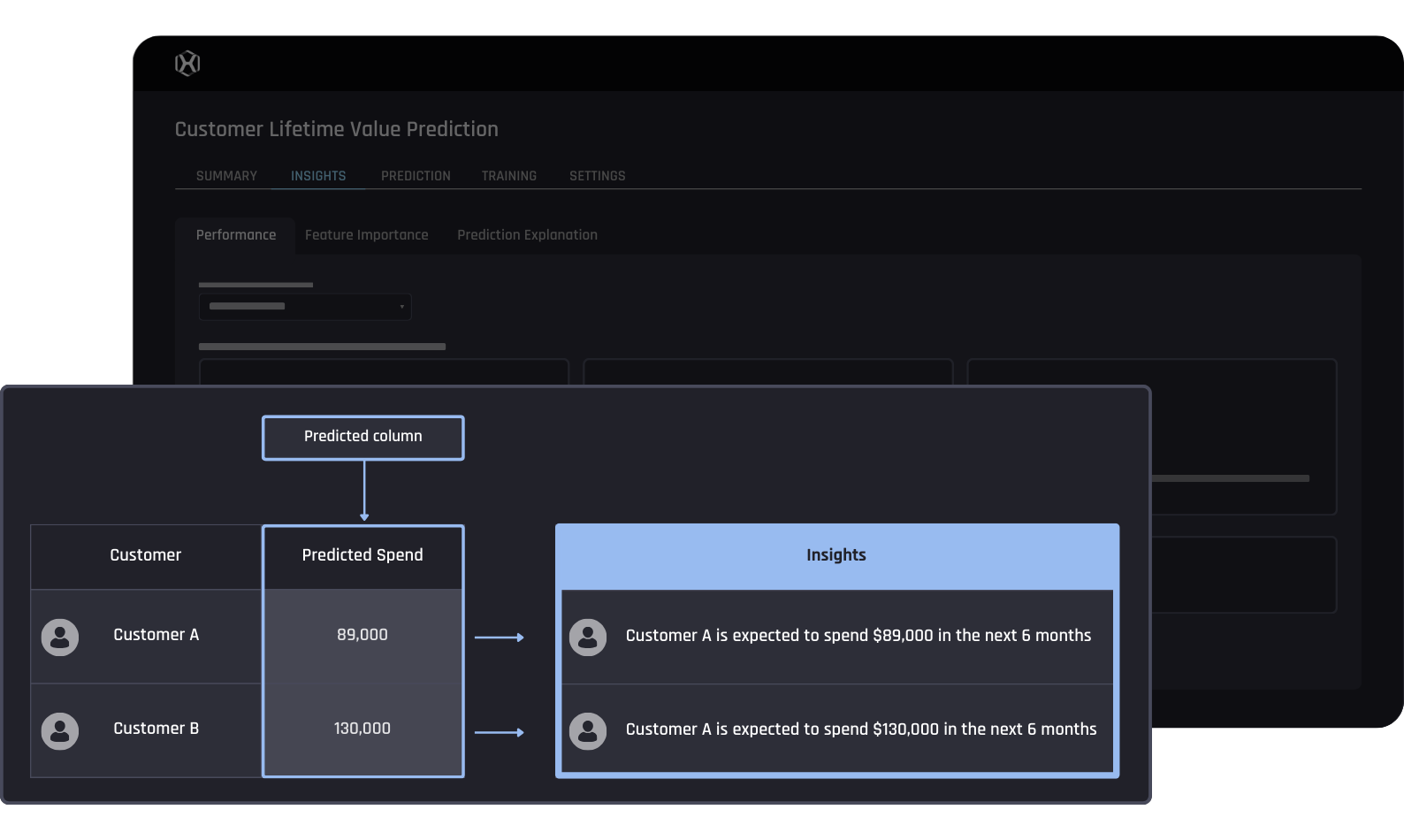

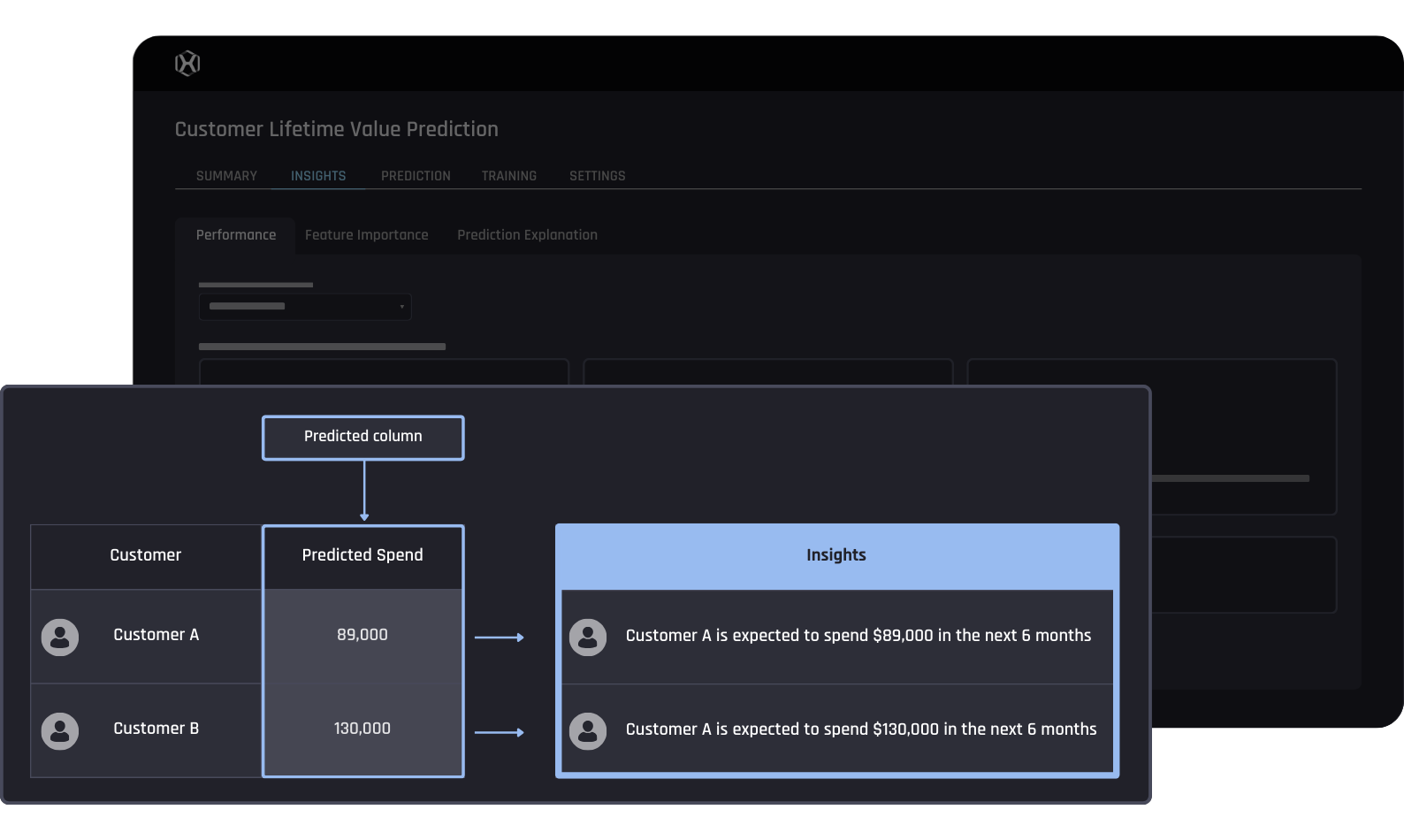

Customer LTV Prediction

The AI & Analytics Engine's Customer Lifetime Value Prediction solution allows banks to identify customers that will produce the most revenue over a given time period. Increase loyalty of customers that drive majority of revenue and gain an advantage over competition.

Generate CLV predictions for each customer

Determine revenue over a given time period

Increase loyalty among high-value customers

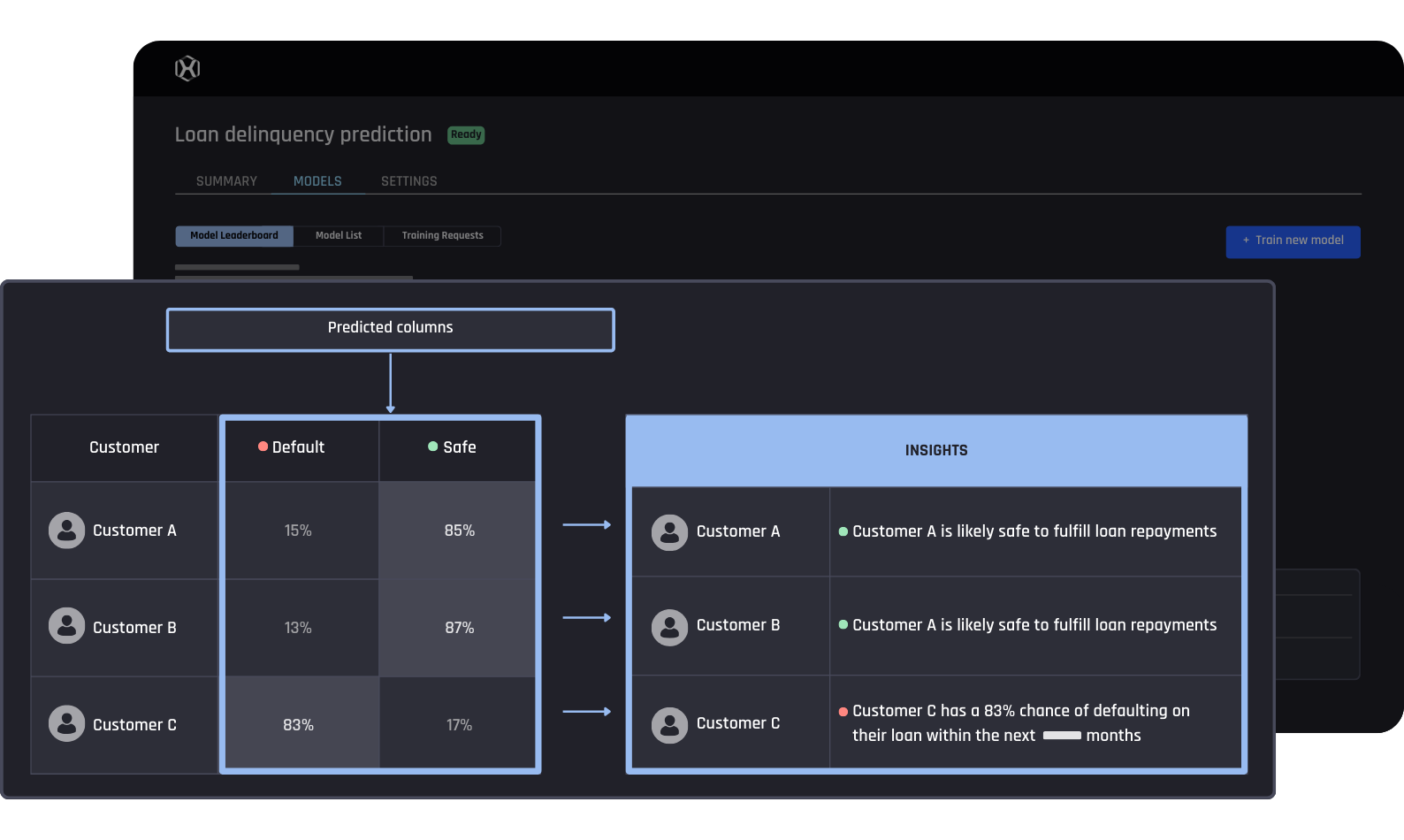

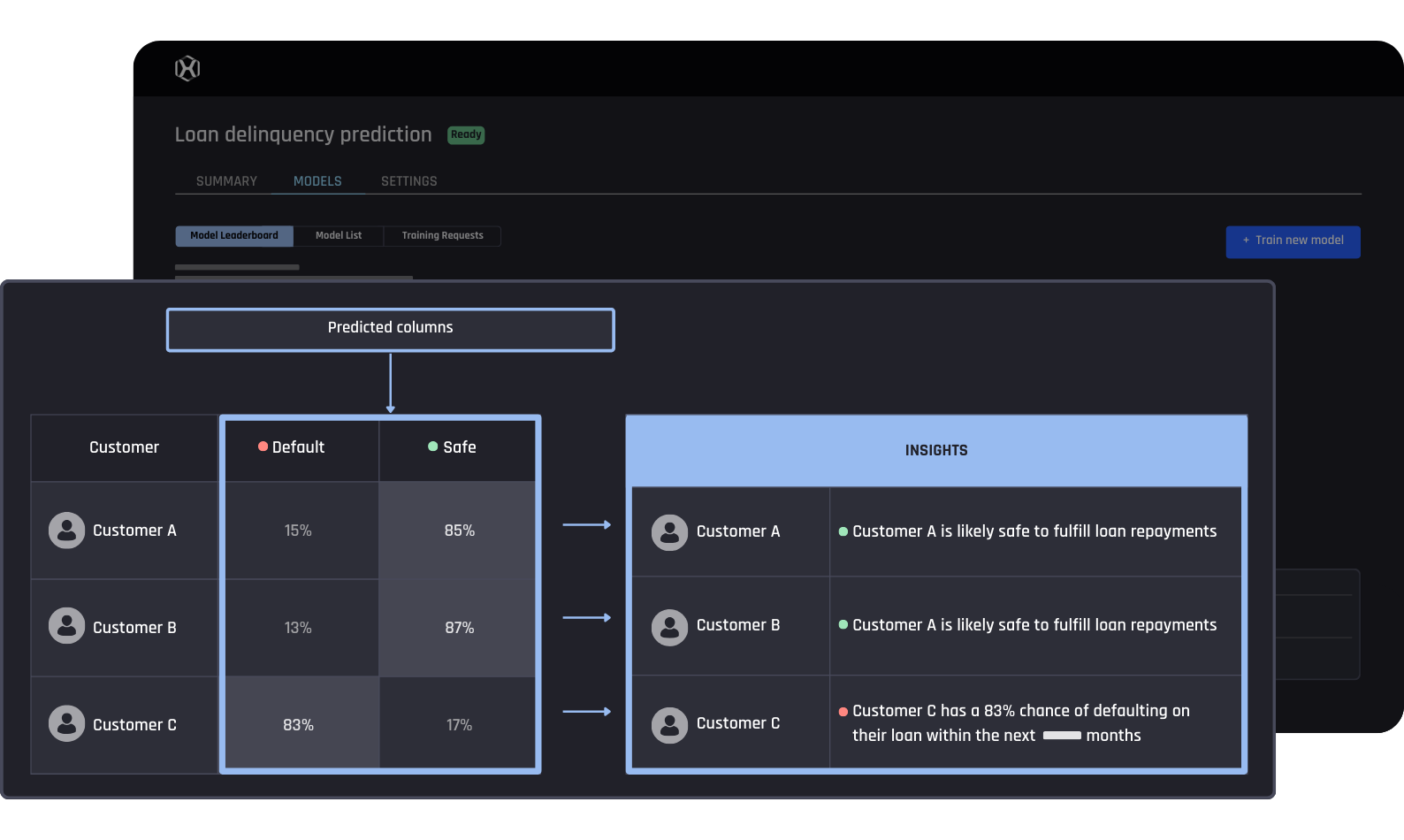

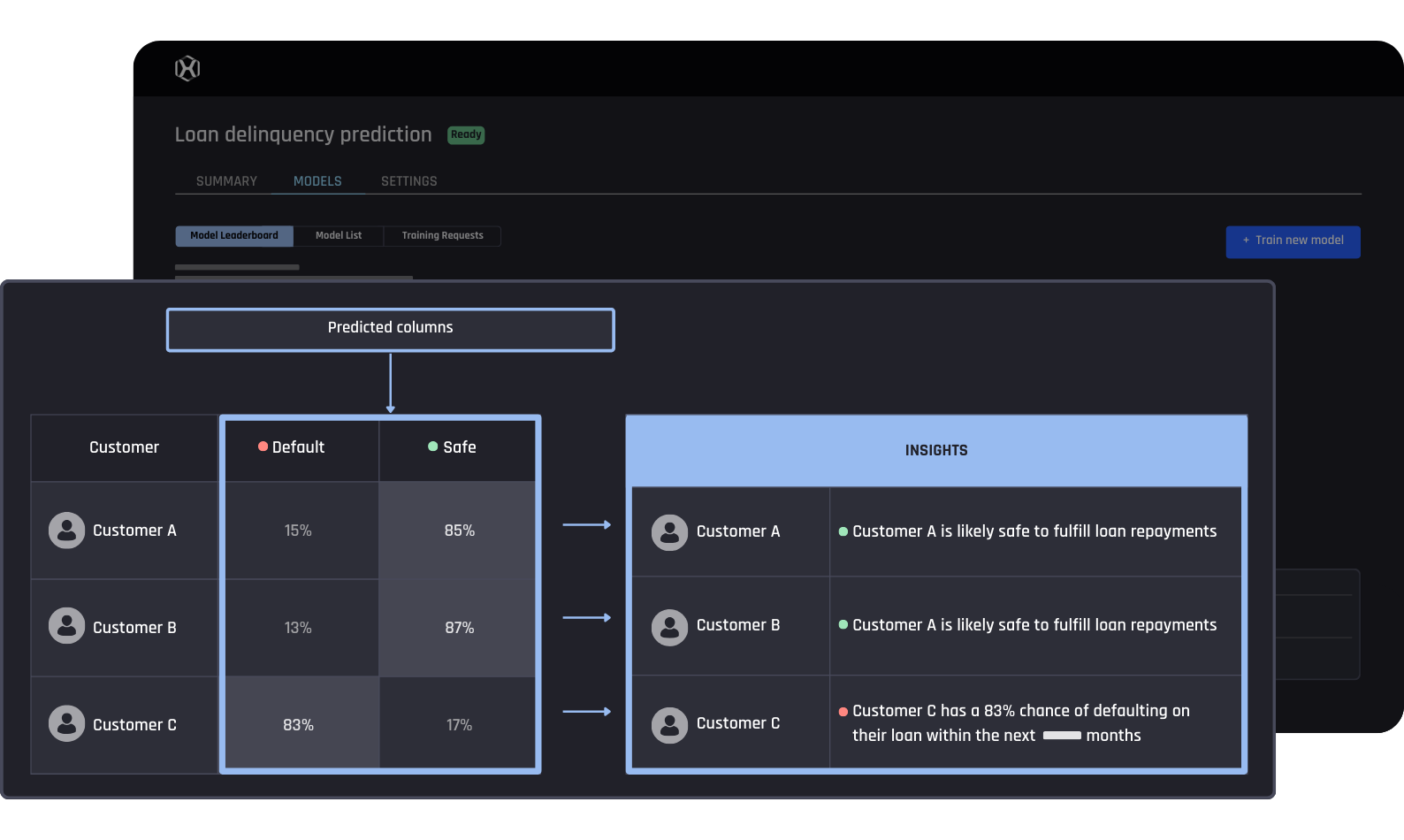

Loan Delinquency Prediction

The AI & Analytics Engine’s loan delinquency prediction solution allows lenders to identify potential loan applicants that are likely to default on repayments obligations. Feel confident making data driven decisions and reduce the risk of bad debt.

Identify potential financial risks of incurring bad debt

Reduce costs associated with loan defaults

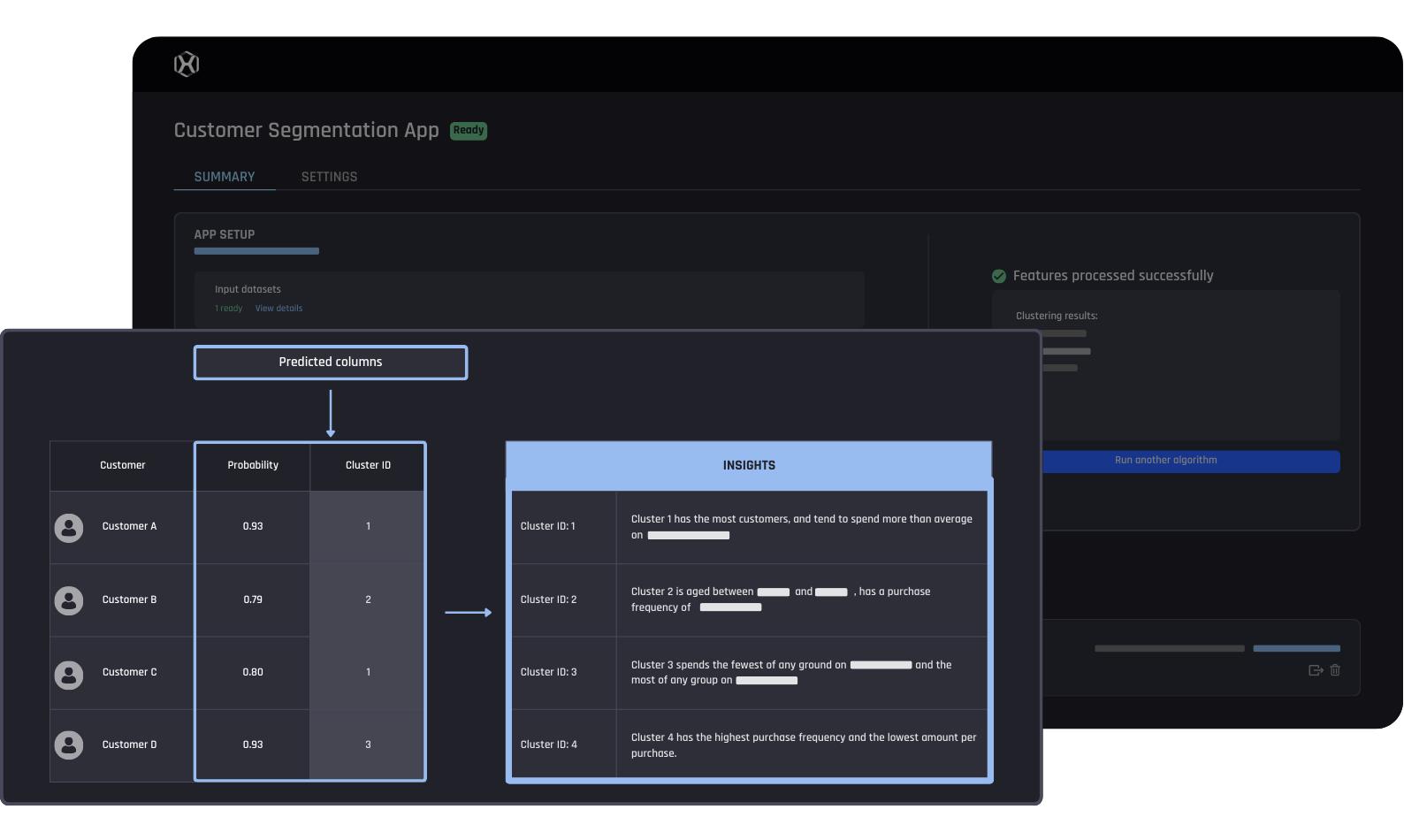

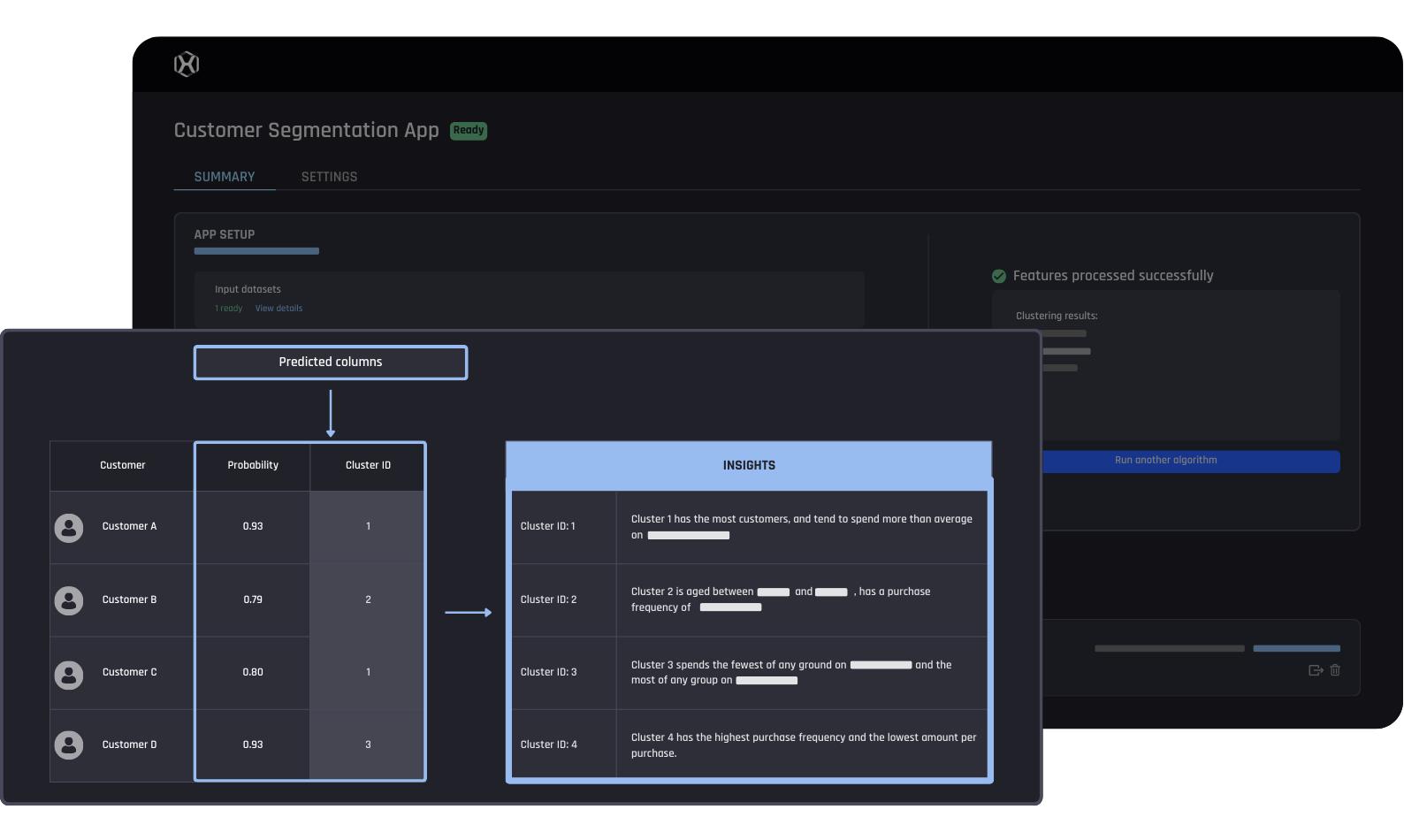

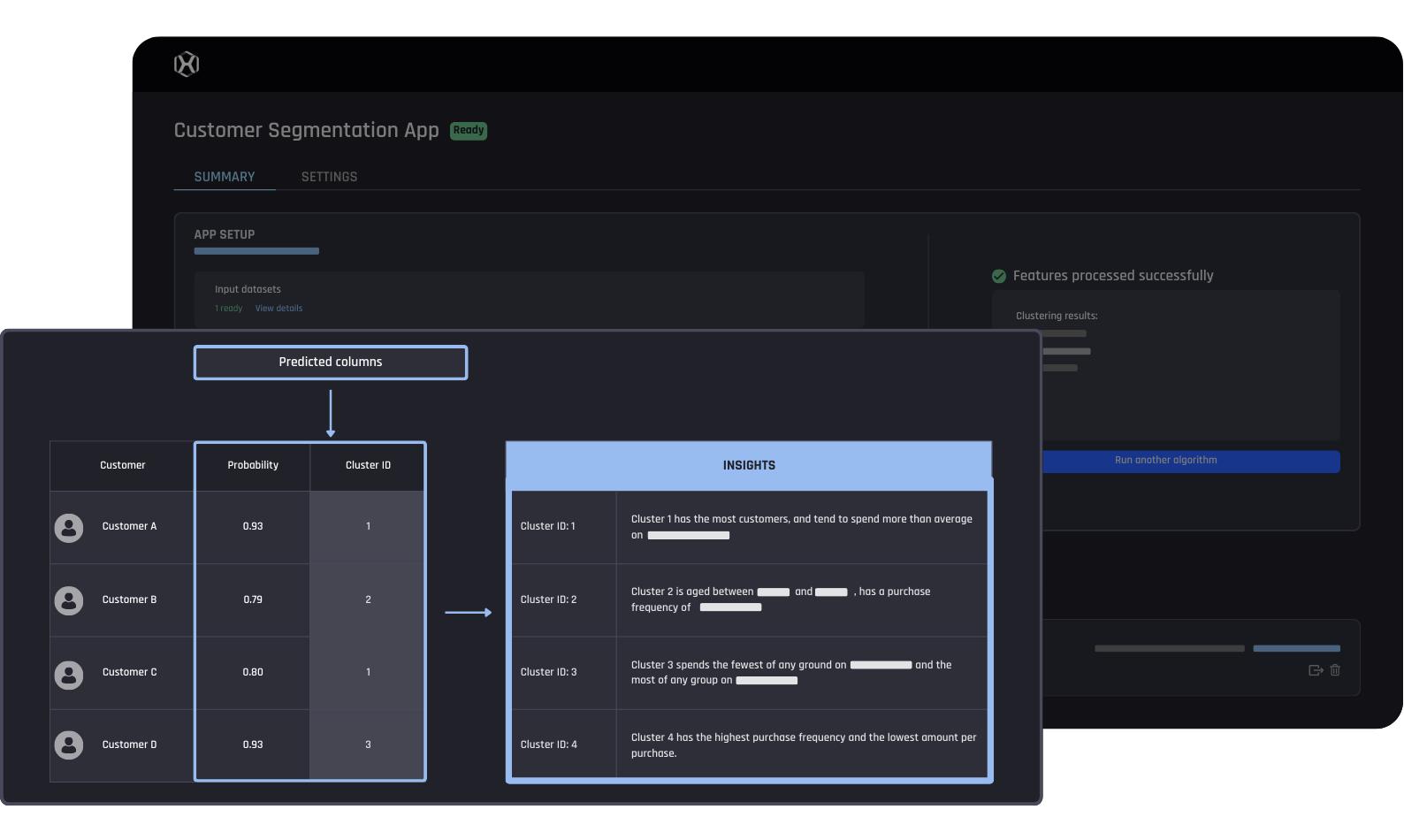

Customer Segmentation

The AI & Analytics Engine’s customer segmentation solution allows telecommunication providers to group customers into natural categories based on demographics, behaviour and preferences. Increase marketing effectiveness by developing targeted offer strategies.

Pinpoint groups of customers that share similar identifying features

Develop effective targeted marketing strategies

Develop effective targeted marketing strategies

Increase revenue with more efficient offerings

The AI & Analytics Engine’s customer churn prediction solution allows banks to identify customers likely to switch to a competitor in the future, giving them an opportunity to proactively address it ahead of time. Keep customers from churning and retain revenue that would otherwise be lost.

Generate churn probabilities for each customer

Increase customer loyalty and revenue

Decrease customer churn rates

The AI & Analytics Engine's Customer Lifetime Value Prediction solution allows banks to identify customers that will produce the most revenue over a given time period. Increase loyalty of customers that drive majority of revenue and gain an advantage over competition.

Generate CLV predictions for each customer

Determine revenue over a given time period

Increase loyalty among high-value customers

The AI & Analytics Engine’s loan delinquency prediction solution allows lenders to identify potential loan applicants that are likely to default on repayments obligations. Feel confident making data driven decisions and reduce the risk of bad debt.

Identify potential financial risks of incurring bad debt

Reduce costs associated with loan defaults

The AI & Analytics Engine’s customer segmentation solution allows telecommunication providers to group customers into natural categories based on demographics, behaviour and preferences. Increase marketing effectiveness by developing targeted offer strategies.

Pinpoint groups of customers that share similar identifying features

Develop effective targeted marketing strategies

Develop effective targeted marketing strategies

Increase revenue with more efficient offerings

Customer Churn Prediction

The AI & Analytics Engine’s customer churn prediction solution allows banks to identify customers likely to switch to a competitor in the future, giving them an opportunity to proactively address it ahead of time. Keep customers from churning and retain revenue that would otherwise be lost.

Generate churn probabilities for each customer

Increase customer loyalty and revenue

Decrease customer churn rates

Customer Lifetime Value Prediction

The AI & Analytics Engine's Customer Lifetime Value Prediction solution allows banks to identify customers that will produce the most revenue over a given time period. Increase loyalty of customers that drive majority of revenue and gain an advantage over competition.

Generate CLV predictions for each customer

Determine revenue over a given time period

Increase loyalty among high-value customers

Loan Delinquency

The AI & Analytics Engine’s loan delinquency prediction solution allows lenders to identify potential loan applicants that are likely to default on repayments obligations. Feel confident making data driven decisions and reduce the risk of bad debt.

Identify potential financial risks of incurring bad debt

Reduce costs associated with loan defaults

Customer Segmentation

The AI & Analytics Engine’s customer segmentation solution allows banks and financial institutions to group customers into natural categories based on demographics, behaviour and preferences. Increase marketing effectiveness by developing targeted offer strategies.

Pinpoint groups of customers with similar identifying features

Develop effective targeted marketing strategies

Develop effective targeted marketing strategies

Increase revenue with more efficient offerings

Helping Banks and Financial Institutions Drive Revenue

Use cases from customers already leveraging the AI & Analytics Engine

Book a Demo

Book a Demo

Have a call with us. to discuss your need and determine if the Engine is right for you

Solution Workshop

Solution Workshop

Together, we’ll help you to define your use case and determine the value it will deliver

Data Review

Data Review

Our team will gauge your data and technical infrastructure to support your implementation